In the complex realm of taxation, terms like “tax erosion” and “tax avoidance” often surface, prompting discussions on ethical fiscal practices and their impact on economies. It’s crucial to unravel the nuances that differentiate these concepts to grasp their implications on government revenue and corporate behavior.

Tax erosion refers to the gradual reduction of a tax base, primarily due to legal means such as loopholes, exemptions, or inconsistencies in tax laws. This erosion occurs within the framework of existing tax regulations, allowing entities to exploit gaps and reduce their taxable income. It is a phenomenon that raises concerns about the erosion of government revenue and the need for consistent and watertight tax legislation.

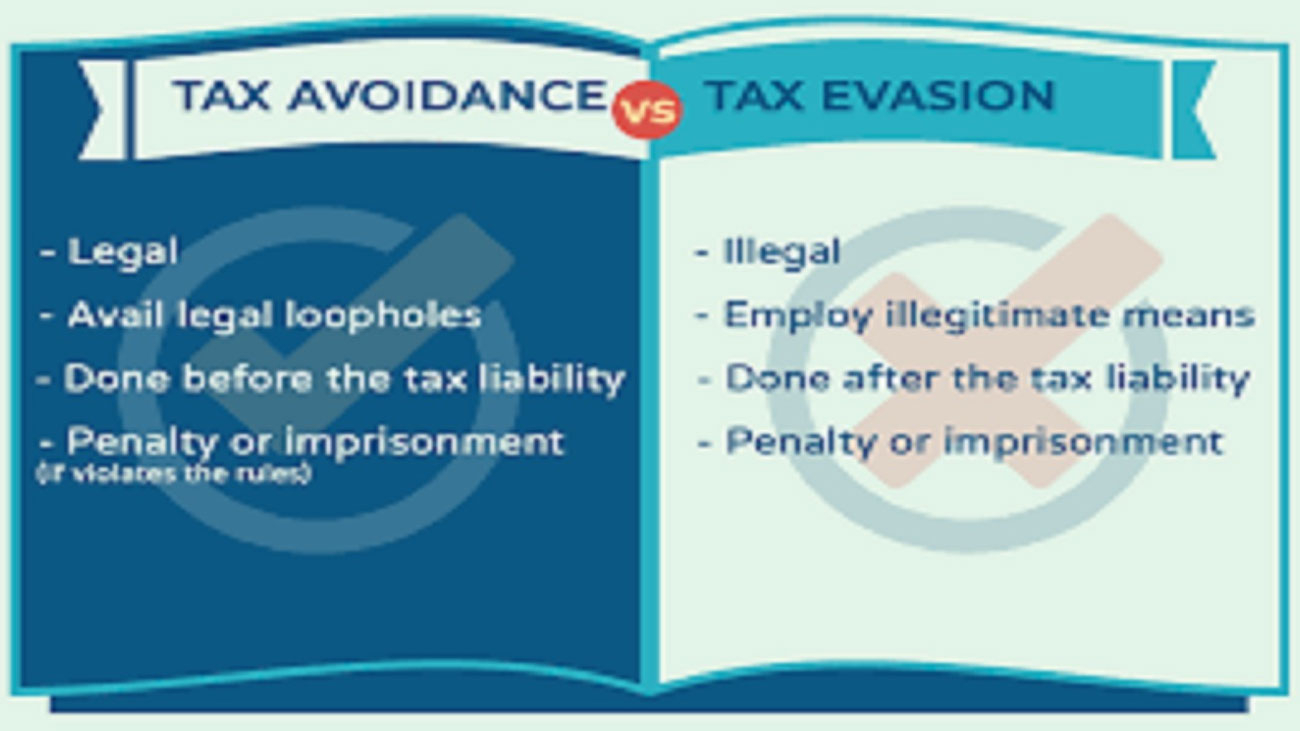

On the other hand, tax avoidance involves strategic financial planning within the confines of the law to minimize tax liabilities. While tax avoidance is legal and adheres to the letter of the tax code, it often draws ethical scrutiny. Companies engage in tax avoidance by leveraging available deductions, credits, and exemptions to optimize their tax position. Unlike evasion, which involves illegal methods to evade taxes, avoidance maneuvers operate within the boundaries set by the tax legislation.

The key distinction between tax erosion and tax avoidance lies in legality and intention. Tax erosion focuses on the unintentional reduction of the tax base due to legislative gaps, while tax avoidance is a deliberate, legal effort to minimize tax obligations through strategic financial planning.

Both tax erosion and tax avoidance underscore the importance of a robust and adaptive tax system. Governments must continuously review and update tax codes to close loopholes and prevent erosion, promoting fairness and sustainability in revenue collection. Simultaneously, businesses must balance strategic tax planning with ethical considerations, recognizing their role in contributing to the public welfare through a fair share of taxation.

In navigating the intricacies of taxation, a nuanced understanding of tax erosion and tax avoidance is essential for policymakers, businesses, and the public alike. Striking a balance that promotes fiscal responsibility, economic growth, and ethical financial practices ensures a harmonious relationship between taxpayers and the societies they serve.

Add a Comment